Quick Facts:

- ➡️ Binance holding 87% of the USD1 supply introduces significant liquidity and counterparty risks, contradicting the decentralized ethos of crypto.

- ➡️ Capital is rotating from narrative-driven assets into fundamental infrastructure, specifically Bitcoin Layer 2 solutions.

- ➡️ Bitcoin Hyper utilizes the Solana Virtual Machine (SVM) to bring high-speed, programmable smart contracts to the Bitcoin network.

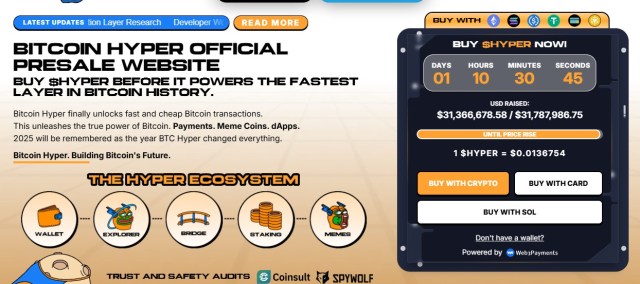

- ➡️ With over $31.3M raised and verified whale accumulation of $1M+, smart money is aggressively positioning in the $HYPER presale.

The narrative of ‘freedom money’ often clashes with the reality of centralized custody, and nowhere is that conflict more glaring than in the recent metrics surrounding USD1.

According to reports citing Forbes and on-chain analysis, Binance now controls approximately 87% of the total supply of the Trump-affiliated stablecoin.

That concentration is alarming. When nearly nine-tenths of a stablecoin’s supply sits on a single centralized exchange, the asset behaves less like a decentralized currency and more like a closed-loop exchange token. It creates a massive single point of failure; if liquidity shifts or regulatory pressures squeeze the custodian, the peg’s stability rests entirely on one entity’s solvency.

The market’s reaction has been telling. While retail investors chase political narratives, institutional capital is quietly rotating. Smart money appears to be pivoting away from centralized stablecoin plays and toward infrastructure that solves the ‘scalability trilemma’, specifically within the Bitcoin ecosystem.

The logic is straightforward: political coins are volatile, but infrastructure that unlocks Bitcoin’s $1 trillion+ dormant liquidity is fundamental.

That capital rotation helps explain why alternative Bitcoin scaling solutions are seeing massive inflows. As concerns over USD1’s centralization mount, investors are hunting for yield in decentralized protocols.

This shift has created a perfect storm for Bitcoin Hyper ($HYPER), a project currently absorbing significant liquidity by promising to bring Solana-level speeds to the Bitcoin network.

Read more about $HYPER here.

Bridging Bitcoin Security With Solana Speed via SVM Integration

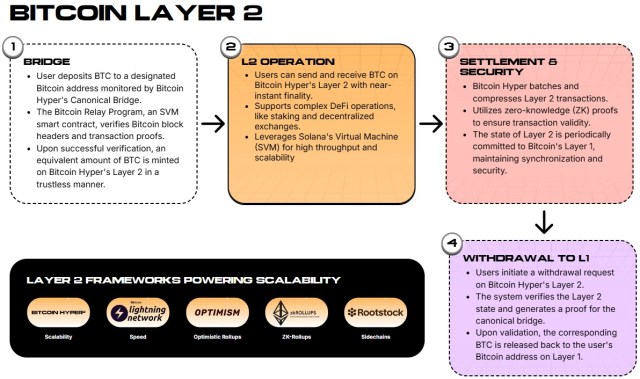

The core value proposition driving interest into Bitcoin Hyper is its technical architecture, which fundamentally differs from previous Layer 2 attempts like Stacks or Lightning. While older L2s often struggle with latency, Bitcoin Hyper ($HYPER) integrates the Solana Virtual Machine (SVM) directly as a Layer 2 execution environment.

Why does that matter? Because the SVM is widely regarded as the industry standard for high-throughput execution. By decoupling the settlement layer (Bitcoin) from the execution layer (SVM), the protocol offers a hybrid beast: Bitcoin’s immutable security and Solana’s sub-second finality.

This modular approach allows developers to build DeFi applications and high-frequency trading platforms using Rust, all while settling transactions on the world’s most secure blockchain.

The architecture relies on a Decentralized Canonical Bridge, which addresses the most common vulnerability in L2s, the bridge itself. Rather than relying on a multi-sig fed by a few signers, the network uses a trusted sequencer with periodic L1 state anchoring. This ensures that while execution happens at lightning speeds on the L2, the final truth always resides on the Bitcoin mainnet.

For developers, this removes the friction of learning niche languages like Clarity (sorry, Stacks). If you can build on Solana, you can build on Bitcoin Hyper. This compatibility is likely a primary driver behind the project’s massive presale figures, opening the Bitcoin ecosystem to thousands of existing Solana devs.

Get your $HYPER today.

Whale Accumulation Accelerates as Presale Crosses Major Milestones

While the Binance-USD1 concentration paints a picture of centralized stagnation, the on-chain data for Bitcoin Hyper suggests a frenzy of accumulation. The project has raised an impressive $31.3M in its ongoing presale, a figure that eclipses most recent infrastructure raises.

The order flow indicates high-conviction buying rather than small retail speculation. A quick look at Etherscan records shows that 3 whale wallets have accumulated over $1M so far. The largest transaction of $500K occurred on Jan 15, 2026.

This specific timing, accumulating heavily well into the raise, suggests that large entities are positioning themselves before the Token Generation Event (TGE).

Investors are currently entering at a price of $0.0136754 per token. The economic model incentivizes early adoption through a high-yield staking program available immediately after purchase.

Notably, the project employs a 7-day vesting period for presale stakers. This short lock-up period is designed to mitigate the post-launch dump often seen in other ICOs, while still providing liquidity relatively quickly.

The sheer volume of capital raised, crossing the $31M mark, validates the market’s demand for a ‘Bitcoin with smart contracts’ solution. As liquidity leaves centralized stables like USD1, it’s finding a home in protocols that offer genuine yield through DeFi utility rather than custodial promises.

Buy $HYPER here.

Disclaimer: The content of this article is for informational purposes only and does not constitute financial advice. Cryptocurrency markets are highly volatile. Always conduct your own due diligence before making investment decisions.